The journey of a stock/commodity trader has changed drastically along with trading itself. Along with the advancement in technology, trading has levelled up too. The advent of Algo trading is now empowering individual traders to trade skillfully using the power of maths, understanding of the markets and technological tools.

The domain of Algorithmic Trading is a lucrative technological advancement, anyone can establish their own algo trading desk and start trading smartly.

How to Setup An Algo Trading Desk:

You need domain knowledge, skilled resources, technology and infrastructure in the form of hardware and software in order to start your own Algo trading desk. The requirements, especially in terms of regulations and cost estimates vary depending on the country to plan to set up your desk.

- Registration / Compliance Approvals: The first and foremost step is to register your firm with the regulators and authorities as per the law of the land where you wish to start your trading desk.

This might mean either taking exchange membership, or becoming an authorised client of a broker, or some similar model.

- Funding: Algo trading at scale requires ample funding for financing your trades, positions and other margin requirements applicable in your market. Show a solid and consistent trading track record where you manage your risk and achieve above-market standard returns, to raise funds from various investors including your own broker.

- Infrastructure Requirements: In order to run a seamless trading desk good quality infrastructure is very important which includes exchange colocation (meaning placing your servers next to exchange matching engine, facility provided by most exchanges), hardware (low latency switches, servers, firewalls, latency booster NIC cards, customised servers) and and network equipments like leased lines which can help you:

- To connect your servers with exchange

- Receive market data

- Send orders and receive executions

- Low Latency Software

- Is built in lower level programming languages like C/C++

- Uses multi threading for parallel processing

- Optimizes hardware usage of multiple cores of CPU for example,

- Uses smart techniques like kernel bypass to achieve faster message transfers

- Has APIs for algos customizations that can be proprietary to you

- And provides a strong pre and post trade risk management that protects and disciplines your algo trading (from any errors, wide market movements, black swan events, etc.)

- Risk Management: It is important for market risk monitoring and auto square offs in case of expected losses.

- Audit and Compliance: All Algos and Algo firms in some countries have to undergo periodic audits by certified auditors or as per exchange / regulator process.

- Human capital: And last but not the least, you need a team of professionals to come together to run your desk. You will need

- Good traders with deep market experience (ideally in a combination of some senior ones who have witnessed some wild market moves, recession cycles etc.)

- IT team to manage your hardware, software, and exchange connectivity

- Risk team to monitor and keep your market exposures in check and discipline all algo users

- Algo developers who can back test and code algo strategies that could become your alpha generation tool

Here is how uTrade Solutions can help you with various aspects in setting your own an algo trading desk:.

a) Colocation: Colocation means that your server is in the same premises and on the same local area network as that of the exchange. Most exchanges provide colocation facilities now.

In some cases when exchanges do not provide a colocation facility, there are vendors who provide proximity hosting facilities.

A significant percentage of orders received by exchanges are then generated by algorithms with most of such orders being generated by co-located space. Based on your latency sensitive nature of target algos, you will need to take colocation (servers next to exchange) to achieve execution based in microseconds or so.

uTrade provides Colocation and data center option which helps you stay close to the action.

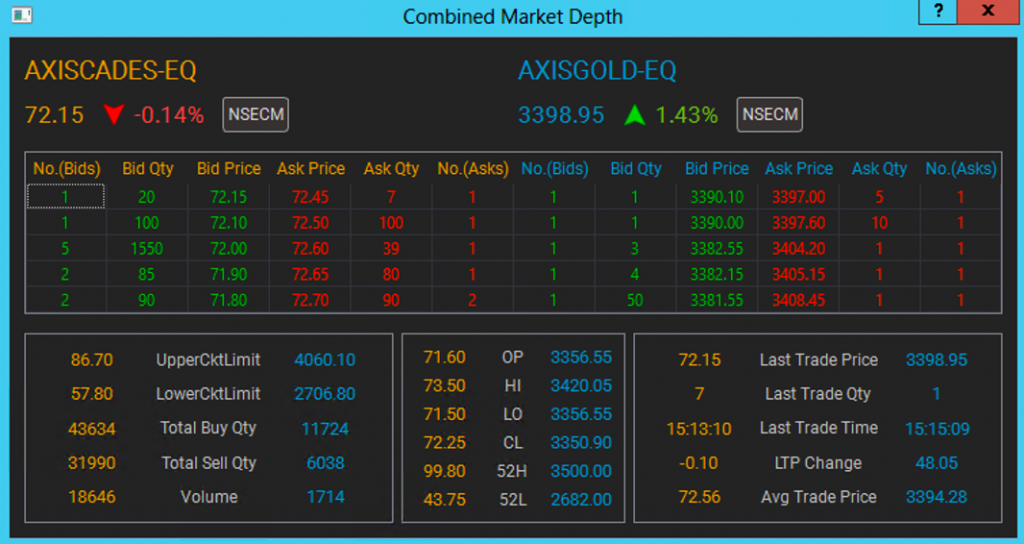

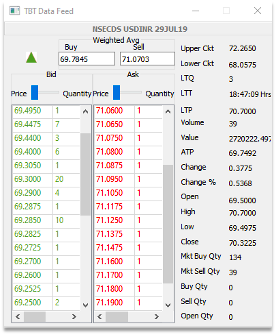

b) Network Lines: Network lines can be broadly categorized into the various categories based upon the use case. Market Data Lease Line is used to receive market data from the exchanges or your data provider. There are two main formats in which exchanges send market data- Tick By Tick or Snapshot Data, with uTrade you can enable both the services.

-> Tick By Tick (TBT)- Tick data is a collection of sequential “ticks” which is the latest quote, trade, price, and volume information. You can also subscribe to bucket feed which filters data for specific instruments requested.

-> Snapshot Data- Snapshot Data feed contains data pertaining to Stock Exchange trade quotations and other related information pertaining to the trading of different instruments generated at regular intervals of time.

Algo Strategies: There are High-frequency strategies (HFT) which are extremely latency sensitive (they can trade more than 1000 times per second) and mainly include market making and arbitrage. Other common trading philosophies include execution based strategies where the focus is to get the best price for execution rather than focusing on Alpha.

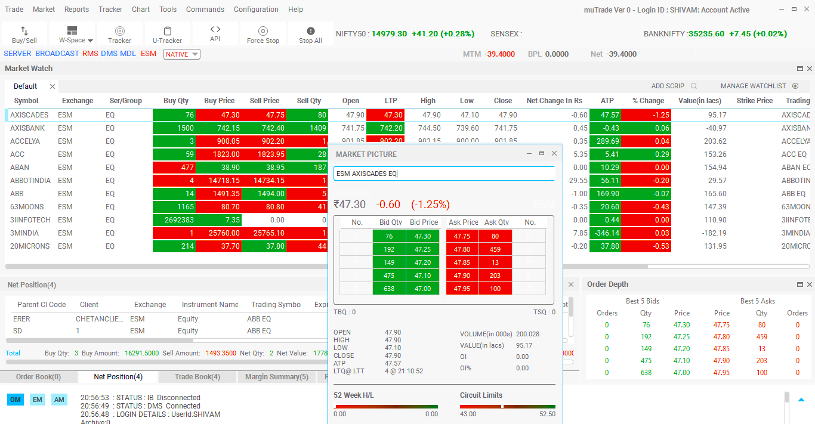

In nutshell, market-maker functions by displaying buy and sell quotations for a specific number of securities.

You can discover more power in pricing and execution rules while generating liquidity in any listed products including equities, futures, options, commodities, indices and currencies with the easy to use Market Making panel from uTrade.

Arbitrage is the process of simultaneously buying and selling of same securities or related securities from different platforms, exchanges or locations to profit on the price difference. While getting into an arbitrage trade, the quantity of the underlying asset bought and sold should be the same. Only the price difference is captured as the net pay-off from the trade.

uTrade comes with strategies designed specifically for exploiting different arbitrage opportunities in the financial markets. Right from taking advantage of the price differences that exist for a security listed on different exchanges, to forming spread combinations across instruments listed on the same/different segments and exchanges.

In order to run arbitrage, you will need to choose the algos based on your trading requirements, risk profile and available margin funds for these algos. uTrade provides variety of powerful strategies for successful trading:

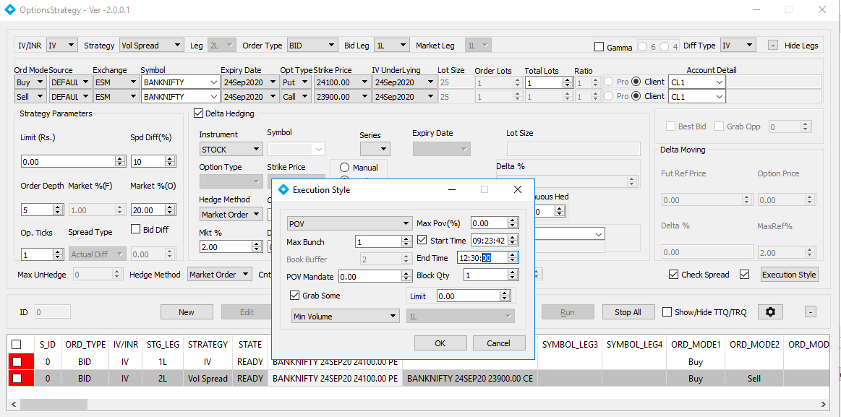

(i) The 2Legs/3Legs/4Legs panel is a powerful strategy from uTrade allowing the user form a wide variety of trade combinations designed specifically for derivatives trading, the strategy can be used for placing Bid and IOC orders across multiple markets and instruments with minimum latency.

(ii) Pair Trade: Grab trade combinations in the markets based on multiple predefined spread conditionals like price ratios, custom metrics that benchmark relative performance of target contracts, and further leverage TWAP and POV execution methods all made available in a single panel.

(iii) Index Arbitrage: Execute spreads between market indices and their constituent securities/contracts, with advanced SOR (smart order routing) facilities that allow auto switching between markets and segments simultaneously to earn risk-free profit from an unusual difference between basket stocks / future / Index prices in the market. There is normally an appreciable and exploitable difference between the cash price and future price, especially at the beginning of the month, known as basis. In a cash-futures arbitrage, a trader sells the futures that are quoting at a premium (or buys the future that is quoting at a discount) to the stock, and buys tuents’ baskets in real time, leverage inventory management tools, perform automated spot price calculations on host server to further minimize latency and assess dividends impact costs in final ledger calculations using uTrade’s Index Arbitrage strategy!

(iv) Cash Future Arbitrage: It is basically a(or sells) an equivalent quantity of the underlying shares, the difference between the two being his profit.

Application Programming Interface (API):

It is commonly referred to as API, which consists of a set of rules describing how one application can interact with another application. It allows you to make your custom algo logics and evolve them when needed, without disclosing your secret “trading logic” to anyone else.

A trading API allows a trader to connect his trading application to the algorithmic execution platform situated at the brokers end and in effect connect with the exchange.

Thus, a trading API facilitates the interaction between these two software and allows for the exchange of data and requests.

Risk Management: Risk management generally involves more focus on Market Risk monitoring. But in the case of High-Frequency trading, Operational Risk is much more important.

Failure of technology, network, data streams can be disastrous. You need to have multiple level checks for data, starting from the socket level to capture any anomalies and stop the strategy instantly if something is wrong. A matter of seconds can lead to huge losses, which makes it important to react very fast and disconnect within a few milliseconds or lesser time duration if things go wrong.

uTrade RMS is a modular and comprehensive risk management solution that can be used for pre trade and post trade risk management across a wide variety of asset classes and stock exchanges. The uTrade RMS offers 150 distinct risk checks and robust risk mitigation tools which are extremely flexible in their configuration These risk configurations may be leveraged either as a primary/online part of the trading system, or as a secondary/offline post risk management kit plugged with a third party order generating system HFT FPGA etc as per requirement.

Advantages of Algo Trading

Speed : Algorithms are composed in advance so you can execute the guidelines consequently. The primary advantage of doing this is speed. The speed is fast to the point that it is hard to take note of, as an individual.

You can examine and execute various indicators at a quick speed that is hard to spot. This empowers trades to be analyzed and executed quicker and gives better chances.

Precision: Precision is essential in algorithmic exchanging. Much like any other business, precision is the key to getting better outcomes in stock trading too. Utilizing computers in trading, you can diminish a few errors that may occur when you perform the same action manually. It encourages you to expel any mistakes prior to trading in the live market.

Cost Reduction: You would not be at the risk of losing your income. You don’t need to invest a considerable time in checking business sectors as exchanging should be possible without your consistent supervision. The time spent on observing the market is radically lessened and gives you the chance to take part in different activities.

Back-Testing Ability: Watchful back-testing enables traders to assess and tweak a trading idea. It enables them to decide the framework’s expectancy – the normal sum that a broker can hope to win (or lose) per unit of risk.

Diversify Trades: Mechanized exchange of frameworks allows the client to exchange multiple accounts or use different techniques at one time. The computer can scan for trading openings over a scope of business sectors, produce orders, and monitor trades.

High-frequency trading: This exchange strategy generates great profits by submitting a substantial number of requests at a quick speed, over different markets and various decision parameters, in the light of pre-customized guidelines.

Benefits of uTrade Algo Solutions

Trusted by over 100 financial institutions and brokerage houses across 18 countries in the world, uTrade’s products offer following services:

- For HFT / market making, you may choose to build your own system from ground up or work on uTrade’s API Kits, which offer a 100% on-demand exposure to the backend infrastructure and internal services so you can leverage uTrade’s ultra low latency backend engine for your trading operations and exchanges connectivity.

- uTrade’s risk system enables you to manage risk across multiple traders, markets, algos and clients in a deterministic robust manner.

- uTrade’s inbuilt 100+algo logics give you a head start to identify trading opportunities in the market

- uTrade APIs are built with proprietary logic by industry experts with hundreds of man-year experiences, to ensure that the strategy code gets the updated data points through the fastest channels possible, and users enjoy the most stable API kits. The API also allows you to design custom alerts and response flows, and is equipped with logics that ensure minimum turnaround latency.

- uTrade’s dedicated and expert team can help you ease the process of onboarding of your traders and can train them end to end in getting hands on with uTrade’s technology.

- uTrade Solutions is a one stop solution providing enterprise software for financial trading, including multi asset trading platform, algorithms risk management solutions, direct market access, exchange solutions and market data broadcast solutions to financial institutions and their end clients. Contact us for end-to-end trading solutions.

Finances lures everyone but financial matters aren’t an easy nut to crack. The world of finance is complex and you need some serious superpowers to deal with it. Investments, trading, returns, etc. add to the complexities of the complex financial world.

Many such instances happen where a human trader is unable to handle the huge numbers of trading. You need to seek help from an intelligent algorithm. This is where uTrade comes into the picture with the magic wand to solve all your Algo Trading related challenges.

Contact uTrade experts for end to end solutions with Algo strategies!!